36+ Mortgage and property tax calculator

Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000.

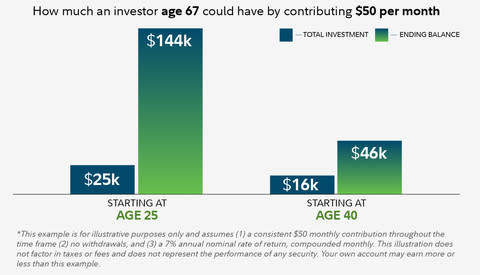

Smart Money Moves Women 18 35 Years Old Start Investing Nearly One Decade Earlier Than Women Ages 36

Want to learn more about your mortgage payments.

. There are a few ways you can improve your mortgage amount. Private mortgage insurance PMI is required for borrowers of conventional loans with a down payment of less than 20. You can also deduct mortgage interest on your tax return.

Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Arkansas Property Tax Calculator. Mortgage and Property Blog.

Your household income location filing status and number of personal exemptions. Average property tax in Texas counties. Here is where you enter the.

If youre a first-time buyer who has never owned a residential property you dont have to pay stamp duty on the first 300000 of the property value if youre buying a home costing up to 500000. Please note that we can only estimate your property tax based on median property taxes in your area. 936 Home Mortgage Interest Deduction.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Please note that we can only estimate your property tax based on median property taxes in your area. Stamp duty for first time buyers in England.

If you buy a 200000 house your private mortgage insurance will cost roughly 2000 annually or 14000 over the course of seven years. Mortgage Enquiries 0330 433 2927. Check out our mortgage calculator.

The median annual property tax paid by homeowners in Summit County is 2540 the eighth-highest amount in the state. Thats also higher than the rates in Kentuckys Kenton Boone and Campbell counties which are located across the river from Hamilton County. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan.

With the interest rates on those loans ranging from 89 to 99 buyers were paying nearly 110th of the property price each year while building equity at a far slower pace. A percentage you may hear when buying a home is the 36 rule. The average millage rate in Pulaski County is 4593.

A common benchmark for DTI is not spending more than 36 of your monthly pre-tax income on debt payments or other obligations including the mortgage you are seeking. Capital Gains Tax Calculator. Community property states include Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin.

Monthly debt payment credit score and down payment savings. Property tax Municipal tax Education tax Other taxes. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

If you and your spouse lived in a community property state you must. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Use our property tax calculator to see how these taxes can affect your monthly mortgage payment.

Calculate your monthly payments for a particular loan amount and interest rate using this mortgage calculator. Buy-to-Let Stamp Duty Calculator. Use this free New York Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

John Charcol in the News. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. Finally the lender takes the difference of rates 40 and 275 04 - 0275 0125 divides that total by 12 to get the monthly intereset rate 0125 divide 12 00104 multiplies the monthly interest rate value by the 36 months 3 years you have remaining on your mortgage 00104 x 36 months.

974 Premium Tax Credit PTC 36. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Municipal tax of 0451568 education tax of 0161000 and other taxes of 0002202 for a total in property tax of 0614770.

An assesment value of 455 500 and fictive property tax rate of Toronto. Effective property tax rates in those counties range from 095 to 117. Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan.

The federal Residential Energy Efficient Property Credit income tax credit on IRS Form 5695 for residential PV and solar thermal was extended in December 2015 to remain at 30 of system cost parts and installation for systems put into service by the end of 2019 then 26 until the end of 2020 and then 22 until the end of 2021. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. They include making a larger down payment making smarter decisions as to the neighborhood where you are looking to buy from and trying to reduce.

These 13 states may tax borrowers on Bidens student loan relief Loan forgiveness wont trigger federal taxes but some borrowers could owe up to 1100 in state taxes analysis finds. PMI typically costs between 05 to 1 of the entire loan amount. Home buyers who have a strong down payment are typically offered lower interest rates.

Please note that we can only estimate your property tax based on median property taxes in your area. During the bubble Japan unveiled a 100-year mortgage but ultimately it served to act more as an estate planning tool than something which made property more affordable. Simply enter the purchase price of your property and the calculator will do the rest.

Municipal tax 455 500 x 0451568 100. The rule states that you should aim to for a debt-to-income DTI. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

If after using the maximum mortgage calculator you find that you have a mortgage value lower than what you would have liked do not fret. Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more. Average property tax in New York counties.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

Tool Rent Vs Buy Calculator Rent Vs Buy Rent Financial Information

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Payment Calculator Mortgage Payment Mortgage

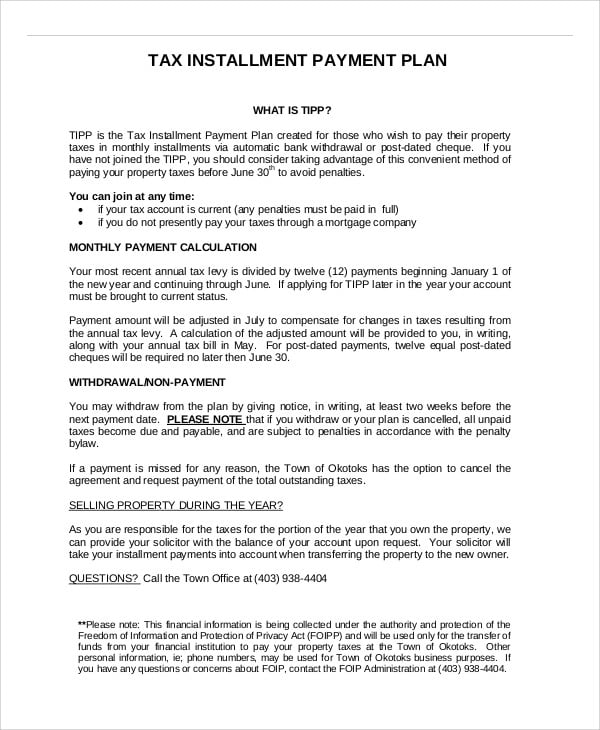

22 Payment Plan Templates Word Pdf Free Premium Templates

Can I Reduce Tax Amount By Keeping My Money Hidden On A Safe At Home Serious Quora

Pin On Financial Ideas

How To Describe A Negative Taxable Income Quora

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

2

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

Free 3 Real Estate Loan Proposal Samples In Pdf

Pin On Real Estate

22 Payment Plan Templates Word Pdf Free Premium Templates

Fha Mortgage Insurance Calculator

Best Of Money Awards 2022 Moneygenius

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers